The History of the Exchange Rate of the Iranian Rial

Jan 20, 2016

The Iranian rial was first introduced in 1798 as a coin equivalent to one-eighth of a tomen or worth 1250 dinar. In 1825, the government stopped issuing rial in favor of the Qiran, which represented 1000 dinars or one tenth of a toman. The rial was reintroduced in 1932 replacing the Qiran at par value.

The exchange rate of the rial in 1932 with the British pound was one pound = 59.75 rials. This slid further down with the one pound being equivalent to 80.25 rials in 1936, then improved to 64.35 in 1939. In 1940, the exchange rate was one British pound equaled 68.8 rials and then jumped to 141 rials in 1941 and then 129 in 1942.

Iran then switched its currency peg to the U.S dollar in 1945 starting with an exchange rate of 1 dollar= 32.25 rials. The rate changed to 1 dollar =75.75 in 1957 and with the devaluation of the dollar I 1973, the new exchange rate now was 1 dollar = 68.72 rials. This later changed in 1975.

Following the Islamic revolution that was characterized by capital flight from the country, there was a deep decline in the currency of Iran. For instance, one U.S. dollar exchanged at 71.46 rials in 1978 and 9430 rials in 1999.

Infusing sudden foreign exchange in the economy after the Islamic revolution resulted in what is commonly referred to as the Dutch disease. This led to a reduction in price competitiveness and hence a reduction in exports. It also causes a shape increase imports. All these affected the performance of the currency.

To help manage the effects of the Dutch disease the rial has been tightly controlled by Iran’s central bank in years after the Islamic revolution. The government also has a tight control over the oil revenue and letters of credit. This controls the exchange rate of the rial, with the government allowing for the normal depreciation of about 4.6% to support non-oil exporters. These ensured that the Rial remained relatively stable in the foreign exchange market until 2011 when the US and the EU effected sanctions against the county’s regime. This made the rial lose about two-thirds of its value against the US dollar.

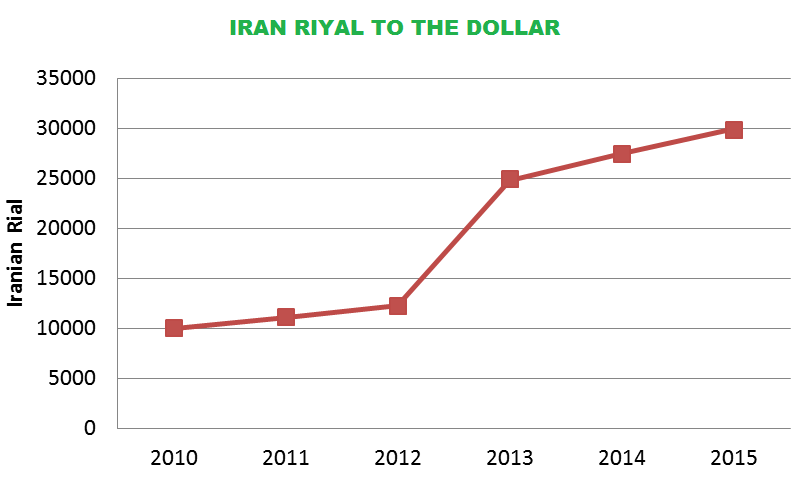

Exchange Rate Between 2010 and 2015

The period between 2010 and 2015 has been marked by a sharp decrease in the value of the Iranian currency against all the major currencies. This is particularly because of the international sanctions against the currency occasioned by Iran’s nuclear program. Iranian monitory policy that resulted in the devaluation of the rial in 2013 is also part of this issue.

Previously, Iran’s capacity to get financing for investments and trade had been

constrained because of lack of confidence in the country’s economy. While the

poor domestic business environment and government policy may be to blame for the

inflation, the international sanctions that have been imposed on the country are

to blame for the recent loss of value for the rial. Reducing Iran’s access to

the global finance market since 2010 has greatly impacted the value of its rial

against all major currencies in the world.

International Sanction and the Exchange Rate

The period between 2010 and 2015 has been marked by sanctions on Iran by foreign powers, key among them the U.S and the EU, which adversely affected the exchange rate of the rial. For example, the U.S has instituted about four acts sanctioning Iran. These acts have had an adverse effect on the currency and the entire Forex market. The U.S acts sanctioning Iran include the FY 2013 NDAA of 2013, the Iran Threat Reduction, and Syria Human Rights Act signed in August 2012, the Comprehensive Iran Sanctions, Accountability, and Divestment Act signed in July 2010, and the FY 2012 NDAA of 2011.

These sanctions have ensured that Iran’s monetary system is considered a money laundering entity by the international banking systems. This has had adverse effects on the rail leading to the multiple depreciation of the currency.

Figure1: Iranian Rial’s Exchange rate against the U.S. Dollar, 2010 – 2015

Immediately after the enactment of sanctions against Iran by the U.S. government the Rial begun to sharply lose its value against the dollar. For the past five years, the Iranian economy has been imploding with, the rial being the biggest causality. For example, in 2012 alone Iran’s currency lost up to 80% of its value. The rial continued its downward trend against not just the dollar but all other major currencies, to in 2013 until it was officially devalued in July the same year.

The EU also joined the US in putting sanctions on Iran, with its council passing six major sanctions against the country. The first came 2010 in the form of the Decisions 2010/413/CFSP, the 2011/235/CFSP of 2011, the 2012/35/CFSP of January 2012, the 2012/152/CFSP of March 2012, the 2012/168/CFSP of March 2012 and the 2012/365/CFSP of October 2012. All these sanctions targeted various sectors of the Iran economy, mainly the oil, and the financial sectors. This has greatly impacted the rial exchange rate for the past five years, thus making the Iranian rial lose close to three quotas of its initial value.

Sanctions against Iran by the EU has led to sharp drop in the value of the Iran’s rial since 2010. This is particularly because the country could not trade with its key business partners in Europe and could not access its revenues to fund its economy. As a result, the government has set up measures to try and curb further sliding south of its currency, but with an acute shortage of the Euro, this has not been successful.

International financial sanctions have made it difficult for Iran to access its oil revenue in the past few years and have thrown the country into a financial crisis that has result in a sharp fall in the value of its rial against all major currencies such as the British pound. The graph above represents the number of rials that one needs to buy one sterling pound. Sanctions implemented by major world government meant that central bank of Iran could not supply the required foreign currencies. As a result, there developed an informal market that harkened the exchange rate. To stabilize the exchange rate the government had to devalue the rial in July 2013.

The international financial sanction imposed against the Iran made it very difficult for the government of Iran to raise enough foreign currencies to pay for its imports, a situation that caused the demand for foreign currencies to surpass the supply thus resulting in the depreciation of the currency. The government policies are also to blame for the falling of the rial. The policy of the Iranian government to micromanage its monetary systems and to monetize its debt has also had a major effect on the depreciation of the Iranian currency. The pressure from the demand of foreign and the government policy have greatly contributed to the depreciation the rial between 2011 and 2015.

For example, in 2009, the monetary policy in Iran advocated for the sale of more foreign currencies in order to curb depreciation and maintain the value of the rial at between 9700 and 9900 rials per U.S dollar. After the sanction begun in 2010, the government shifted to a policy of trying to intentionally weaken its currency by withholding the supply of hard currency so as to have a more rial dominated income especially when the government begun to face budget deficits. This created a wide gap between the official and the unofficial exchange rate that stood at over 20% in 2012.

Following the international sanctions against the central bank of Iran in 2012, the exchange of US dollar against the rial study at 17,000 rials per dollar. This depreciation had some positive effects on the economy given the fact that it helped boost the competitiveness of Iran’s domestic products abroad. This made the unofficial rial exchange rate fluctuate especially when the mechanism that the bank uses to set interest rates were liberalized. Finally, the central bank of Iran decided to set the exchange rate of rial to the dollar at 12,260 rials but by September 2012, Iran’s rial had depreciated to a new low of 26, 500 to the US dollar. The rial further fell to 38,500 by October as a result of the market forces. The further decline in the value of the rial forced the government to officially devalue the rial in July 2013.

Devaluation of the Rial in July 2013

On July 6th 2013, the Iran’s central bank announced a drastic devaluation of the rial in an effort to shore up the country’s faltering economy. Prior to being officially devalued, the rial had shed off up to 80% of its value beginning 2012, when the impact of the harsh financial sanctions by the U.S and the EU begun taking shape. Before the devaluation of the rial, the central bank of Iran sold the US dollar at 24 779 rials, which was a subsidized rate for basic commodity importers. The subsidized rate, however, represented a 102% depreciation of the rial since January 2012.

The new rate, however, was still lower than the actual value of the rial. Did help increase the availability of the dollar in the market, but was sufficient to stop further depreciation of the rial against major world currencies. With the signing of an interim agreement on the nuclear program with world powers, the Iran got a number of sanctions relief in late 2013, which helped shore up the rial for a short period of time.

Source